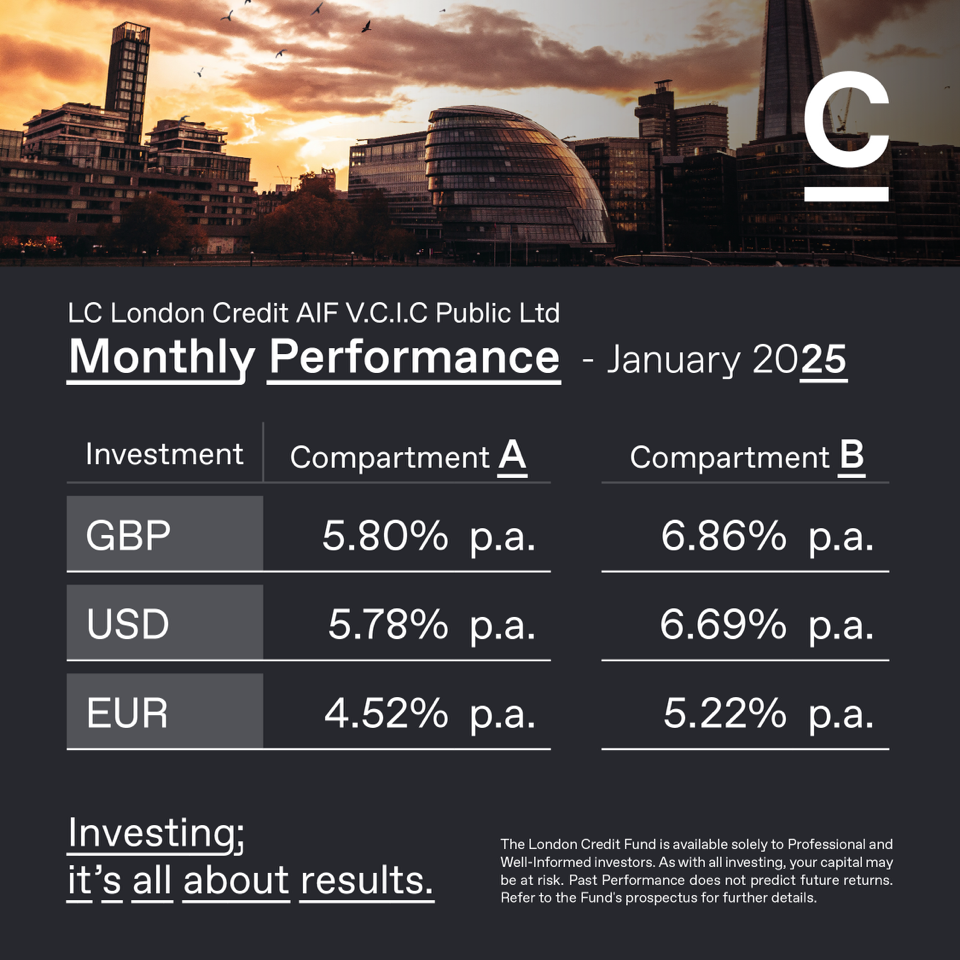

With the conclusion of the first month of the year, we present the London Credit Fund’s performance for January 2025, constistently exceeding target returns across all compartments:

Investment Compartment A:

- 5.80% p.a. on £, exceeding its annualized target return of 5%

- 5.78% p.a. on $, exceeding its annualized target return of 5% and

- 4.52% p.a. on €, exceeding its annualized target return of 4%

Investment Compartment B:

- 6.86% p.a. on £, exceeding its annualized target return of 6%

- 6.69%p.a. on $, exceeding its annualized target return of 6% and

- 5.22%p.a. on €, exceeding its annualized target return of 5%

Why invest in London’s real estate market?

With its combination of stability, demand and liquidity, London consistently draws significant international investment. Notably, data from BNP Paribas’ real estate division revealed that in Q1 2024, US-based investors increased their activity in London’s commercial properties, investing £1.9 billion – a sixfold increase from the previous year, highlighting the enduring appeal and resilience of the market.

London remains one of the most liquid real estate markets in the world, offering stability and growth potential. At London Credit Fund, we understand how to navigate this landscape, delivering strong, risk-adjusted returns for our investors.

“London: The foundation

for resilient real estate investments.”

Get in touch today

Contact us today and benefit from strong returns and access to one of the world’s most resilient property markets.

Email: info@consulco.com

Phone: +357 2236 1300

Disclaimer: Please refer to the LC London Credit AIF V.C.I.C. Public Ltd (“the Fund”) prospectus before making any investment decision and consult your financial advisors. There are various risks to consider, including currency fluctuations, which may affect returns. Past performance is not indicative of future returns. The Fund is available only to Professional and Well-Informed investors.